Blended Finance: An Overview

What is Blended Finance?

Blended finance is a a strategy that combines the right mix of capital from multiple stakeholders who have different risk-return requirements on their capital but common impact objectives. It is often seen as the strategic use of philanthropic funding to “catalyse” private capital into impact investments with the aim of increasing impact by accessing larger, more diverse pools of capital from commercial investors:

As the diagram above indicates, blended finance is sometimes referred to as catalytic capital. In chemistry, a catalyst is a material that enables a reaction, but is lost in the process - this can be a helpful way of thinking about philanthropic funding in a blended finance arrangement, and there are many possible ways that this funding can be used. For example, philanthropy can:

Fund earlier, such as funding feasibility studies or seed stage investments;

Fund “around the edges”, such as learning or evaluation purposes, which can be used to demonstrate the value of a particular blended finance arrangement that others can use in the future;

Fund higher risk investments on concessional terms, for example, taking a first loss position on an investment, providing guarantees, funding investments over a longer term or helping lower the cost for private capital to participate.

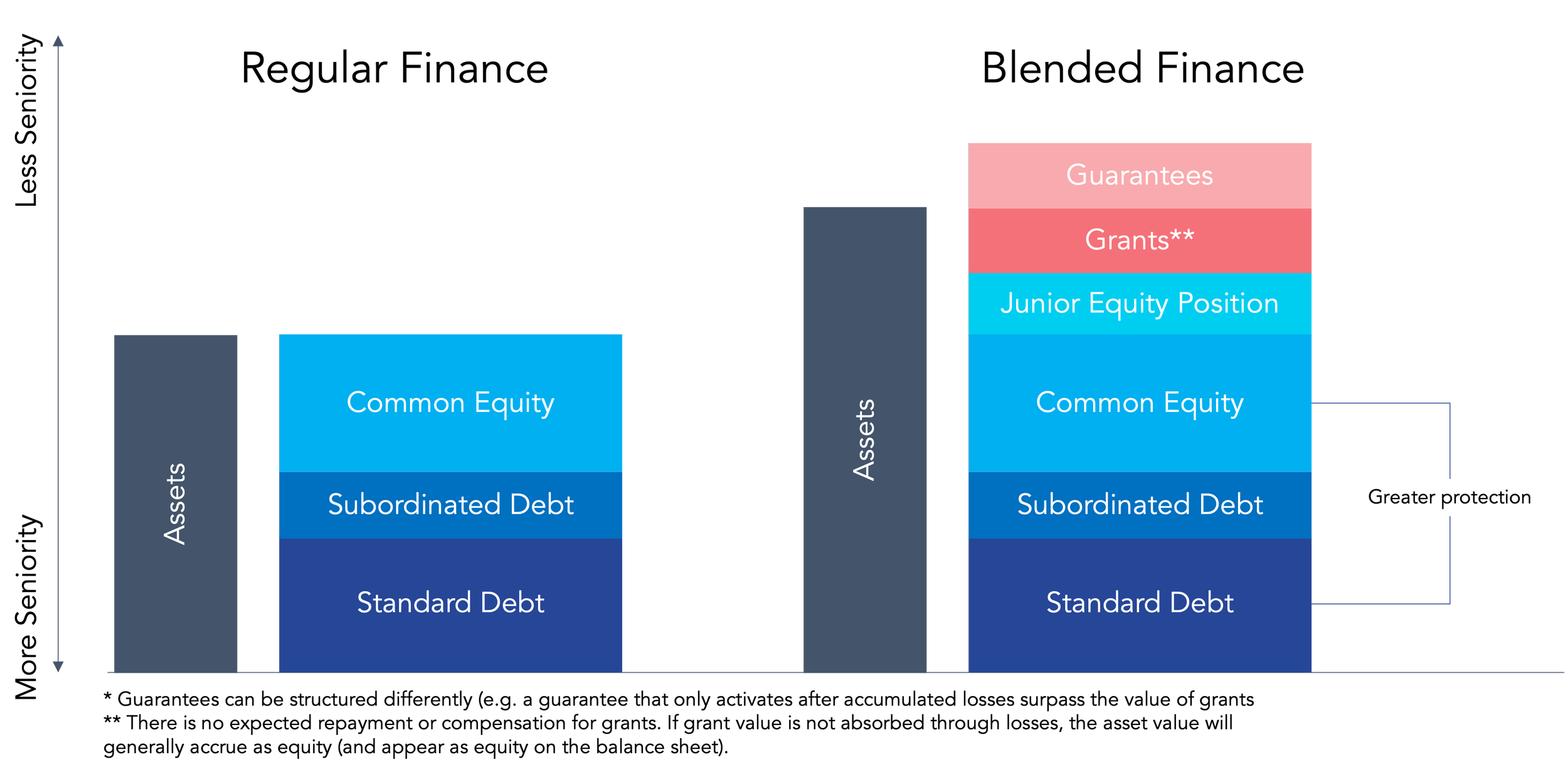

There are different types of blended finance structures that can be used to deliver the optimal financing arrangement for both the investees and investors. The diagram below provides and example of a blended finance structure in comparison to a ‘regular finance’ structure:

Types of Blended Finance

When thinking about how a blended finance structure could be used to create impact, it can be helpful to consider the level at which the financing will take place. The CFO Coalition for the SDGs provide a helpful visualisation to distinguish these different levels, as well as a suite of case studies on their website:

Blended Finance in Action

Case Study 1: Renew Property Maintenance (Powered by Dismantle), Australia

Renew raised $450,000 in low cost debt in two tranches that enabled us to prove our ability to scale (the initial $200,000 from Spinifex Trust was raised in Oct 2021, and the second round led by Minderoo Foundation in March 2023) as well as $500,000 of philanthropy from Paul Ramsay Foundation.

The capital will enable ReNew to:

Scale in response to our existing pipeline of demand for our services

Tender for and execute on contracts currently beyond the reach of our existing scale

Employ an additional 5 work crews (50 young people) in the next 9 months

Case Study 2: Amateur British Gymnastics Investments Limited, UK

Big Society Capital worked with Blended grant and loan fund investing in new and improved gymnastic clubs in England

Challenge: Lack of dedicated gymnastics facilities in the UK, restricting children and young people from participating in sport from an early age.

Blended Finance Solution: Big Society Capital (BSC), British Gymnastics, Sporting Assets and Bank Workers Charity made available £10 million in affordable loans to fund up to 150 new or improved gymnastics facilities, creating up to an additional 75,000 gymnastics places.

Fund:

$10m fund providing unsecured loans of ~£25,000 to £250,000 supporting clubs to move into new, or expand or safeguard existing, dedicated gymnastics facilities.

Grants blended from British Gymnastics and Sport England (~£4 million) together with capital from BSC (£3.3 million) and Bank Workers Charity (£200,000)

Source: Big Society Capital